The real estate market has really galloped in the last two years and in some market regions price increases of 10 to 15% have been recorded - per year. There was no region and no product that did not increase. This raises the question of which factors are responsible for these enormous price excesses and whether this development will continue.

Covid and minus interest rates as biggest fire accelerators

Covid and home office have dramatically increased the demand for real estate. The change in housing needs and the new flexibility to move the place of work to the home have also boosted peripheral markets. The negative interest rates have provided the best support for the fact that people would rather invest the money in usable tangible assets than see it melt away in the bank account.

The second home initiative and Covid as a toxic mix

The markets with the greatest price distortions concern the tourist regions. Here, the second-home initiative ensured that the last residential properties under the old law were still completed between 2014 and 2019 and that the original oversupply was absorbed in practically all regions by 2020. Ticino and Valais still have the most liquid markets. In Graubünden and the Bernese Alps, however, the markets have dried up. Here, the enormous increase in demand met with a supply that did not expand further. An increase in demand, by the way, that was mainly concentrated on domestic interested parties due to travel restrictions and the possibility of working from home. Holidays in one's own country are popular with the Swiss, and having one's own holiday domicile is coveted.

The loser is the primary residence market in tourist regions

Nevertheless, the tourism regions are not growing in terms of first homes. There is a noticeable migration to the Central Plateau. In addition, the federal government has instructed cantons with negative population trends to demarcate building land reserves that cannot be built on within 10 years. In this way, building land reserves will be withdrawn from the market for primary residences in the coming years. However, this market for primary residences is dependent on affordable living space. It should also be noted that home offices and tax optimisation opportunities - pension fund payments are up to 50% cheaper in Canton GR than in cantons on the Central Plateau - are encouraging more and more people from the Lower Swiss to move to the mountains. They can benefit from lower prices compared to a second home and usually also compared to an expensive home in the urban midlands. The local population suffers from this development. Should it be realised in a few years that the second-home initiative has prevented affordable housing for all in the Alpine region, it could be reversed with a new initiative. But even if a new initiative were to be adopted, it would then no longer be possible to create living space for first or second homes, since the building land reserves have been neatly eliminated by the canton. After all, the canton can refer to the fact that we once accepted the initiatives and laws on spatial planning. However, it is doubtful whether the electorate really knew how toxic these various laws and initiatives would be.

Housing shortage in cities due to new interpretation of old laws

The latest development concerns judges who suddenly reinterpret old laws and ordinances, thus in effect creating new laws and starting points. A very questionable role is played, for example, by new federal court rulings on the subject of noise protection, which are then interpreted quite differently by the courts in cities such as Lausanne or Zurich. Flats may not be built in the city of Limmat because the street is suddenly too noisy. In the city of Zurich alone, two questionable rulings have prevented more than 200 new flats from being built. It would be welcome if these questionable federal judges were unmasked and had to discuss their rulings publicly and controversially, so that these issues come into the public discourse and an awareness arises on a broad front that affordable housing is prevented with such rulings. That is why politics is now called upon, because from left to right, everyone has the same interest: The city belongs to everyone and for that we need new housing. That's why new noise protection regulations must be introduced that enable investors to build urgently needed new buildings.

Misunderstood protection goals prevent new buildings

Furthermore, the federal inventory of sites worthy of protection ISOS, which was originally only intended for federal buildings, is now declared binding for new buildings in entire cities. It simply protects sites and thus old buildings, and no one ever had or has the opportunity to take a stand on these protection goals. There was also never a vote on ISOS. Here, the federal government has created a building negotiation construct without the people. Nevertheless, the courts have taken up the idea of ISOS and thus prevented many new buildings with questionable decisions. Today, every objector tries to justify objections with ISOS, and unfortunately these are all too often granted.

The desired densification in the cities can therefore not take place as planned. If demand remains very strong, this will have a significant impact on the supply side. The result is very significant price increases, which are further fuelled by the new added value levy on rezonings. Behind this are civil servants and politicians who avoidably fill the coffers of the canton and municipalities at the expense of the middle class, who will soon no longer be able to afford home ownership. A grievance that has hardly been discussed publicly so far and of which few are aware and which should also be taken up by all political parties: If we punish urgently needed rezonings with excessive value-added taxes, this is another factor why there will be a lack of affordable housing in the conurbations in the future.

Outlook into the future

The real estate market itself will in all likelihood continue to develop well. The above-mentioned government measures and restrictions to reduce supply, the continuing very low interest rates and the large increase in money on the stock exchanges and in real estate markets will give the market the necessary impetus. According to a survey by a major bank, only 7% of buyers can currently afford a property in the Zurich area on their salary. In order to nevertheless raise the necessary equity capital for private real estate, up to 80% are apparently using advance withdrawals and inheritances. Accordingly, a large transfer of wealth will take place in the next few years to a younger generation that has the necessary purchasing power for real estate even at a high price level. This is also at the expense of the middle class, which is increasingly being excluded from this market. A development that in the long term will lead to a change in the structure of society, a healthy population mix and the labour market in the sought-after urban regions of Switzerland.

Quelle: Wüest Partner

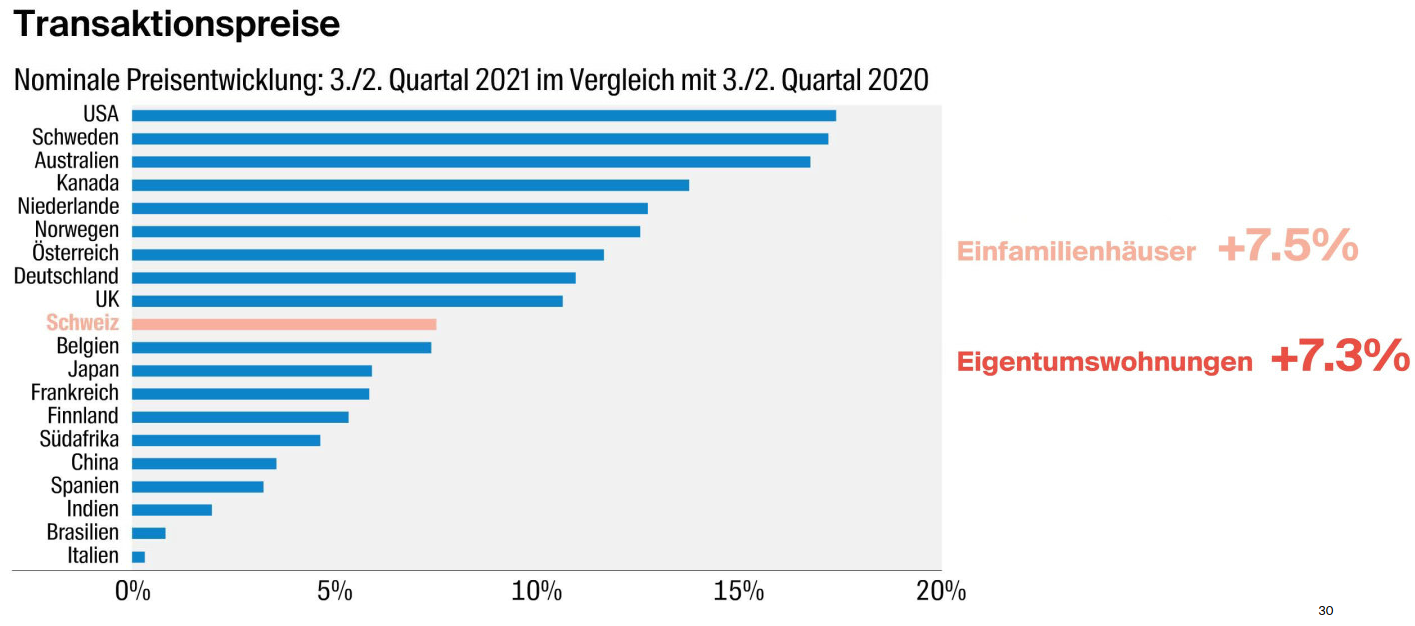

Internationally, the development in Switzerland is in the middle range. The price increase between the second quarter of 2020 and 2021 was around 7.5% for private property. In the USA, Sweden or Australia, prices have increased by almost 20% in this period. These markets therefore have the greatest risk of a decline. In Switzerland, moreover, there is no speculation, because the existing land reserves and the long approval procedures do not allow for "production on stockpile", as can be observed in markets with infinite land reserves, especially in boom times.

Thus, despite the rapid pace of development, the pace of development in Switzerland is somewhat more moderate than elsewhere. Which will be to our advantage if one or the other price-determining factor changes. And dark clouds have been visible on the horizon for a long time.

Here are the main events that could slow down the market and perhaps even put it into a downward trend:

- Geopolitical events such as (trade) wars or a break-up of the EU.

- New financial crisis due to global debt crisis.

- Interest rates in Switzerland rise very rapidly by at least 1.5%. Whereby the first 0.75% would not even be felt. In addition, 90% of mortgages are secured with long-term interest rates, which would simply lead to a postponement and staggering of the resulting problems.

- State regulations like in 2013, when the National Bank tightened the credit guidelines.

According to the cycle theory, the market should also experience a downturn after an uninterrupted upswing since 1995. Moreover, real estate inflation has no correlation with effective inflation, which was -0.1% from 2011 to 2021.

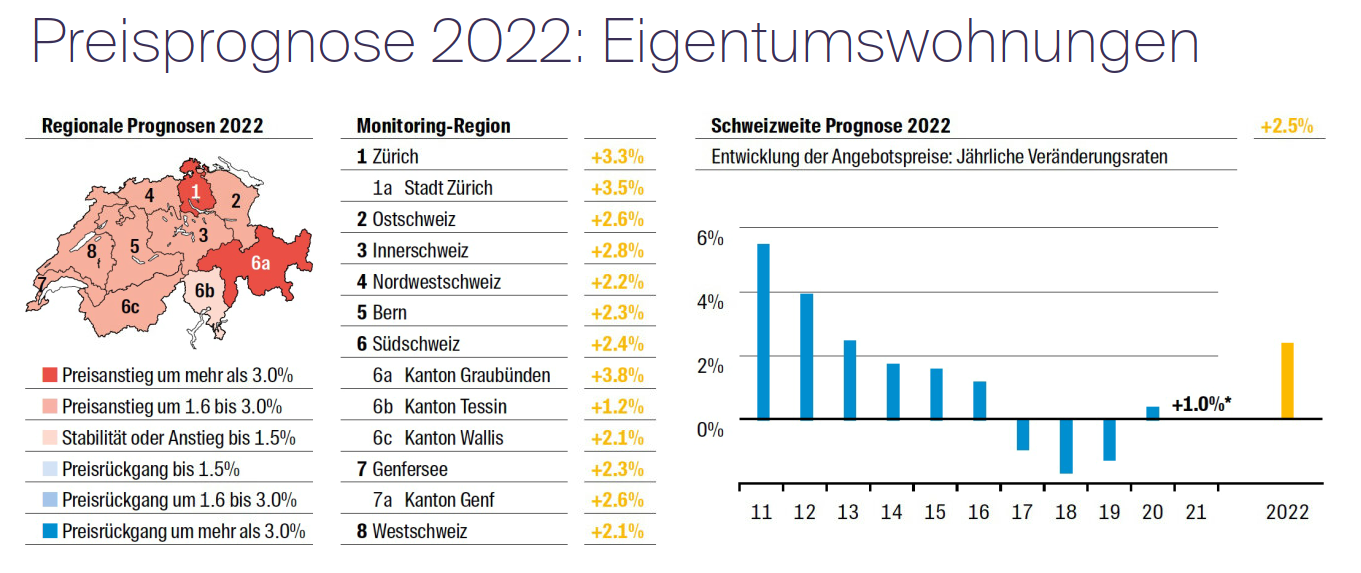

Quelle: Wüest Partner

For the time being, however, negative interest rates continue to drive investors to put their money into real assets, cryptocurrencies or shares. These markets are "state-sponsored" as a result of the expansive monetary policy of the national banks. Even the SNB has today created a kind of "sovereign wealth fund", which in terms of size, at around CHF 1,000 billion, can be compared to the 2020 mortgage market at CHF 1,138 billion. One reason why the SNB probably does not intervene more actively in the real estate market: with its expansive monetary policy, it has made itself a systemic risk.

Quelle: Wüest Partner

Quelle: Wüest Partner

Finally, a look into the crystal ball

Sellers will also be happy about the achievable prices in 2022. Those who can afford to buy residential property or a holiday home are probably still well advised to invest their money in a tangible asset in the current low-interest environment. And for those who wonder whether and how they will be able to afford home ownership or even renting in one of the metropolitan areas in the future, I recommend sharpening your eyes and ears for the state, cantonal and local decisions, new laws and votes that provide for more or less housing. The topic is important, affects us all and the time is ripe to start the public discourse on a broad front and to get involved. I recommend that all Zurich residents read my article on the means by which the middle class is being driven out of the city.