On the occasion of the «Immo Talk Graubünden» presented by newhome.ch (one of Switzerland's leading real estate portals), on 4 October 2023, the three real estate and financing specialists Sascha Ginesta of Ginesta Immobilien, Martin Gartmann of Graubündner Kantonalbank and Claudio Quinter of the Graubünden Homeowners' Association took a close look at the real estate market.

These are the most important findings:

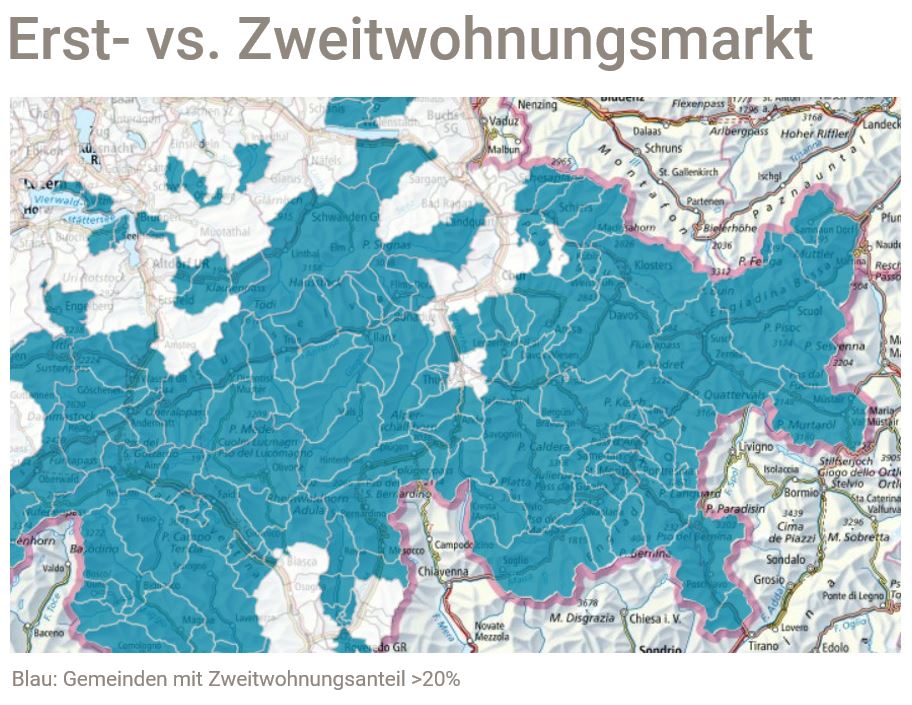

The primary and secondary residence market

Only a few municipalities, such as the regions of Chur and Imboden, the Chur Rhine Valley and parts of Domleschg, are not affected by the second-home initiative. Only in these can holiday properties continue to be built freely. In all other municipalities where more than twenty percent of the properties are holiday homes, construction is only possible under certain conditions. Primary residences may, of course, continue to be built there, as long as spatial planning permits.

Source: Swisstopo, ARE

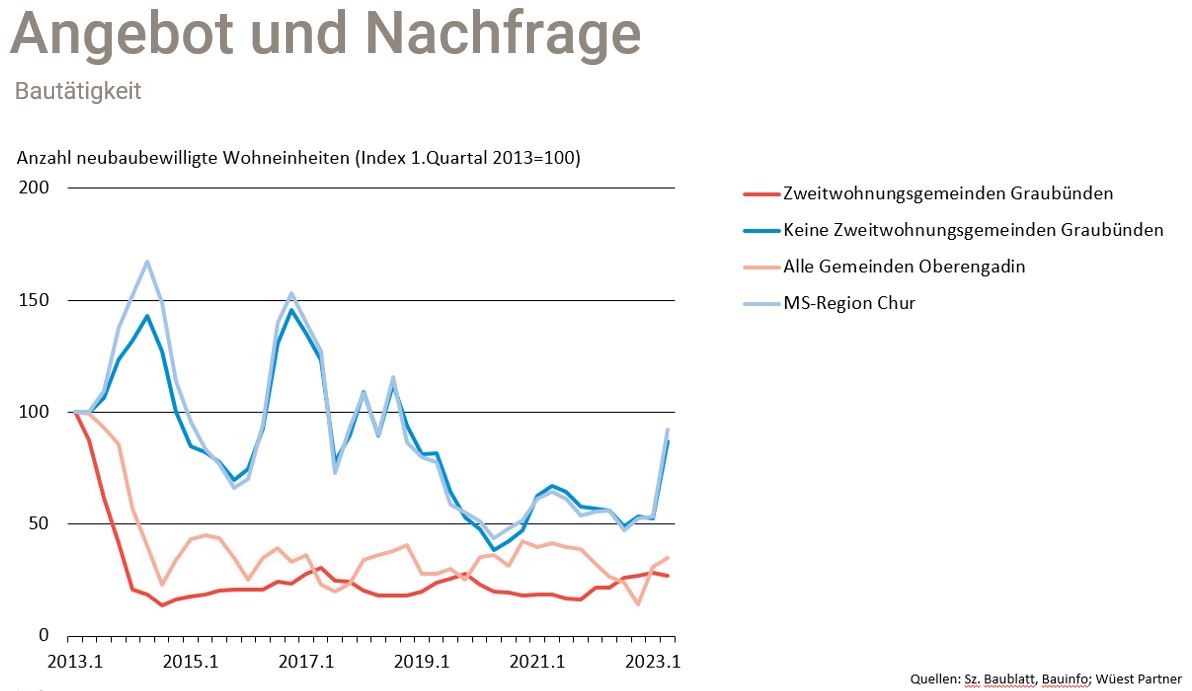

Offer situation

Since the second-home initiative came into force in 2013, construction activity in the holiday home communities has fallen sharply, to about one third. The decline has – as in Switzerland as a whole – also been in the area of primary residences, although not to the same extent. An important indicator of what this means on the offer side is the development of vacancies. And this vacancy rate is currently at an alarmingly low level of 0.6 per cent on average.

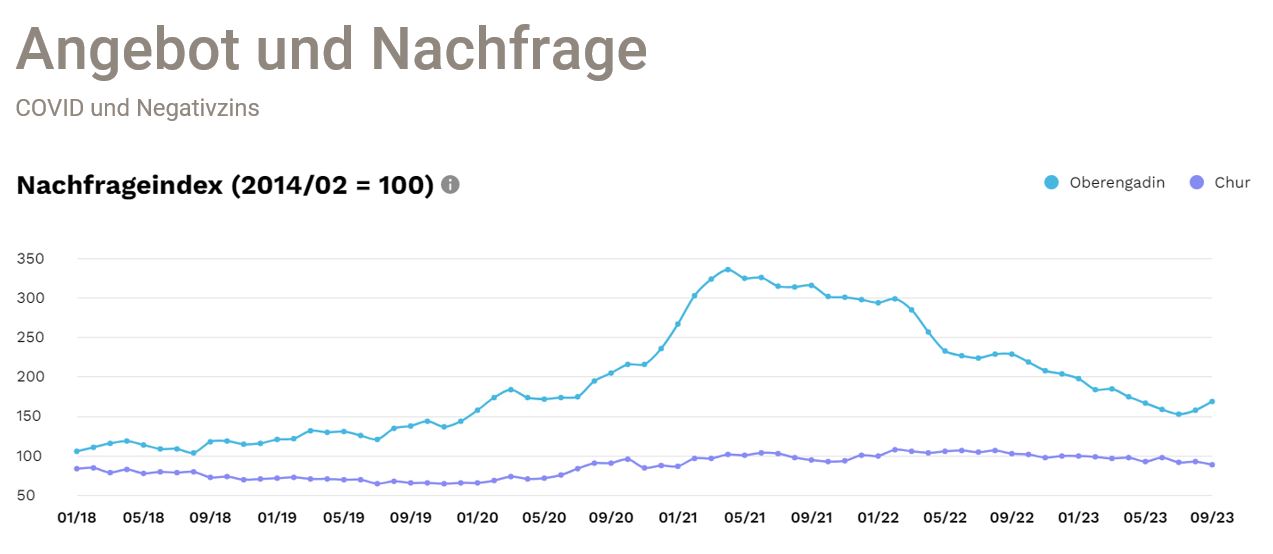

Demand situation

In regions of first residence, this is directly correlated with population development. The tourism communities have developed below average in comparison to the rest of Switzerland, which also has to do with the displacement by foreign, high purchasing power that buys up the real estate market without settling there. In addition to these buyers of second homes, COVID and the persistent negative interest rate were added in recent years, which have shaped demand until spring 2023. With the end of the pandemic and the interest rate hikes, the situation has settled back to where it was in 2020. What is different today: The supply is even smaller due to the low level of construction activity. The Chur region, on the other hand, as an attractive economic area, is experiencing a steady increase in population with an equal increase in demand for housing.

Source: Realmatch360, Kauf Wohnung

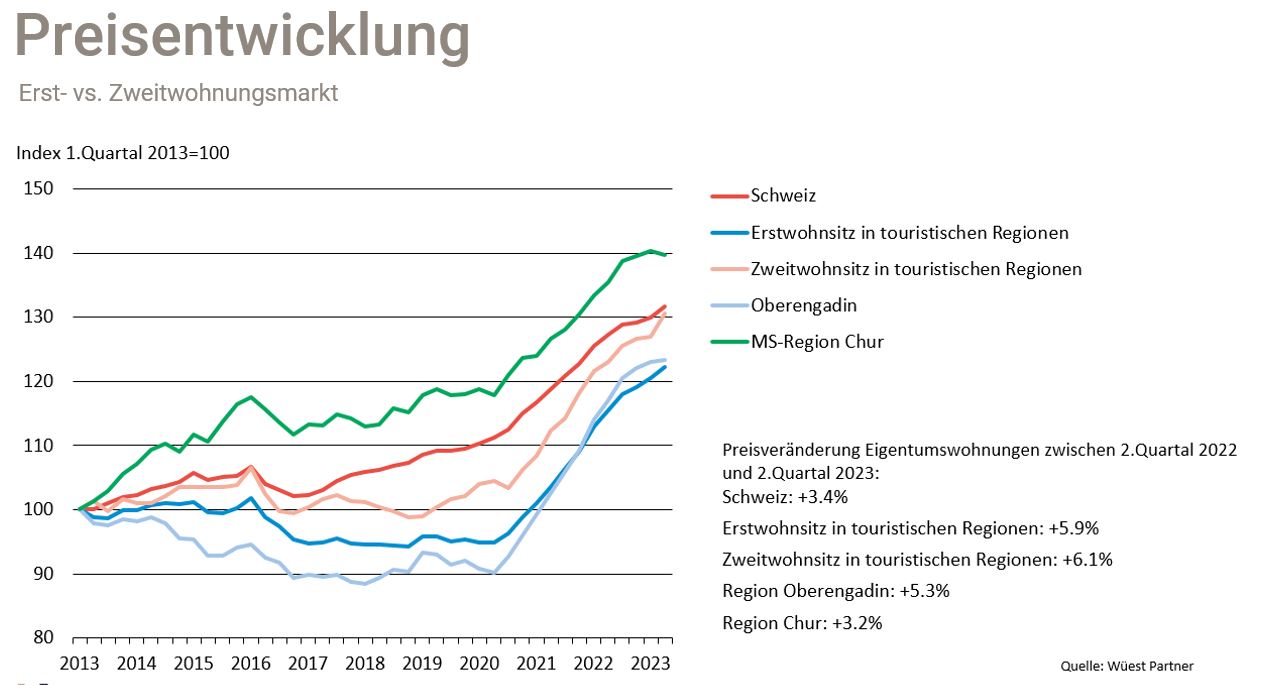

Price development

The reduced offers, the low construction activity and the demand have an impressive influence on the price development. These prices have risen significantly everywhere, and even more so in the tourist communities. In some cases, prices have risen by up to thirty percent in the last three years. In these tourist regions, this has also made primary residences significantly more expensive. As was found in the municipalities affected by the second home initiative, both real estate categories - existing second homes and first homes - are developing to the same extent, even if not at the same level. Since autumn 2022, however, a calming of the market can be felt everywhere and prices are developing mainly laterally, only slightly upwards in some cases. However, as supply remains low, these prices are expected to remain at least supported.

Source: Wüest Partner

Current political initiatives

In addition to offer and demand, politics naturally also has an influence on development. Currently, the following transactions affecting the real estate market are being discussed in parliament at the federal level:

- Secure power supply with renewable energies

- The enforcement of tenancy law - keyword "abusive subletting".

- The abolition of harmful restrictions in the law on second homes

- Transparency in the purchase prices of real estate transactions - keyword "money laundering".

- The imputed rental value and the deduction of costs for investments

- The Spatial Planning Act

In addition, there are these parliamentary initiatives at the cantonal level:

- A new approach for May estates outside the building zone

- The action plan for primary residences

- The relaxation of the law on second homes

- The promotion of housing in mountain areas

- The Action Plan for Electric Heating

At the municipal level, there are also proposals that are currently being discussed. Here are some examples:

- Affordable housing for locals

- The introduction of a second-home tax or incentive taxes

- Short-term rentals, for example via Airbnb

- The housing subsidy for families

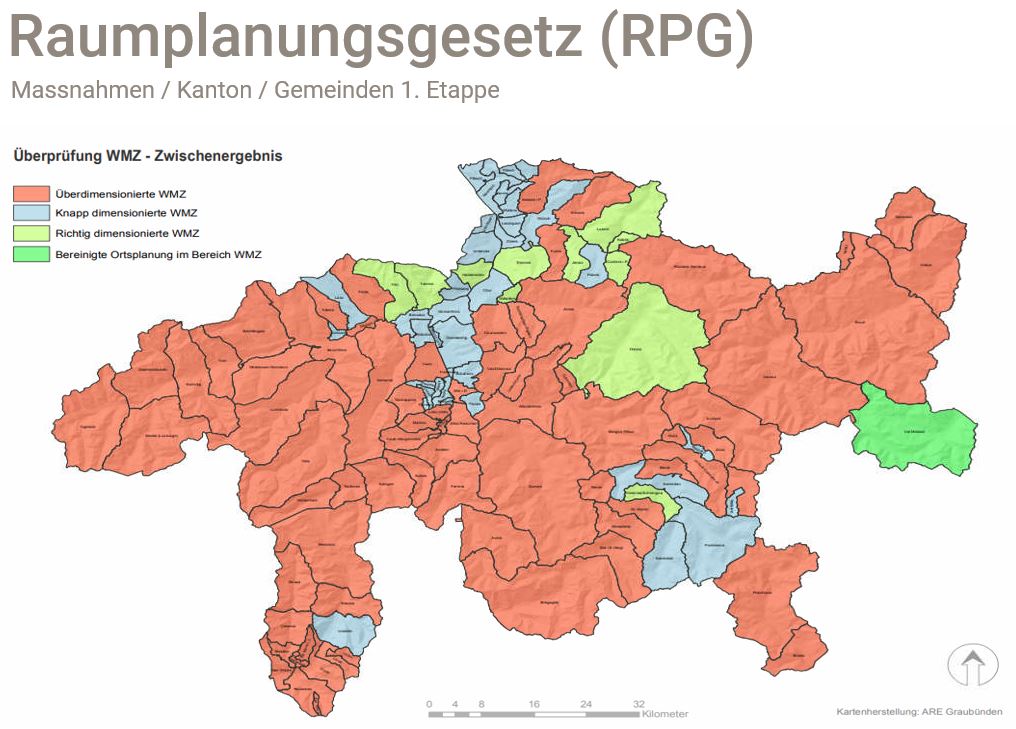

The Spatial Planning Act RPG

A comprehensive set of rules on how to deal with the available land in Switzerland. Among other things, this states that only as much building land may be zoned as corresponds to the demonstrable demand for the next fifteen years. Supposedly surplus building land must be zoned out. This is a hot topic, because most of the municipalities in the canton of Graubünden have large reserves that have already been zoned and are threatened with this fate. And a topic that leads to many follow-up questions, such as the basis for calculating the building land requirement, compensation in the case of zoning out, building obligations and internal densification.

Source: Kartenherstellung: ARE Graubünden

The danger of overregulation

Today, a multitude of national, cantonal and municipal regulations make it difficult for investors to build the new buildings desired by politics and society within a reasonable period of time. Many of these current initiatives and discussions are causing frustration and in some cases leading to sensible projects being rejected at an early planning stage and not being built. In addition to the lack of building land, this means that construction activity cannot keep pace with population growth.

Last but not least: The financing

The good news for prospective buyers: Despite the rise in interest rates, demand for mortgages has not slowed down. The market is playing and those who want to buy today have more options when developing their individual financial strategy, but of course they still have to be adapted to their personal circumstances.

As a reminder, here are the most important things you should know about financing:

- The purchase price does not always represent the basis for the loan, as the valuation of the financial institutions can be lower.

- Currently, an imputed interest rate of 4.5 to 5 percent is used for the affordability calculation.

- A mortgage must be amortised to two-thirds within fifteen years.

- If energy-efficient renovation is planned skilfully, subsidies can be expected, financing can be more advantageous and substantial tax savings are possible.

Conclusion

The great challenge today in the canton of Graubünden and in Switzerland as a whole is to promote construction activity again so that it can keep pace with population growth and thus demand in the respective location. This is the only way for the markets to calm down again. Like you, we are eager to see how the newly elected parliament will contribute to this.

For those who want to delve deeper into the topic, we recommend the entire one-hour video of this «Immo Talk Graubünden».