All-round broker on the rise

Comprehensive real estate brokerage models that satisfy individual transaction-related needs are coming to us; real estate services related to brokerage services will be offered in the future as a bundle. This also includes the brokerage of insurance, mortgages, fiduciary services and other services. With these additional services, the broker is to establish new sources of income and thus compensate for falling commissions in the transaction business. Here is an entertaining advertising video of a broker who advertises himself with all services and fixed commissions.

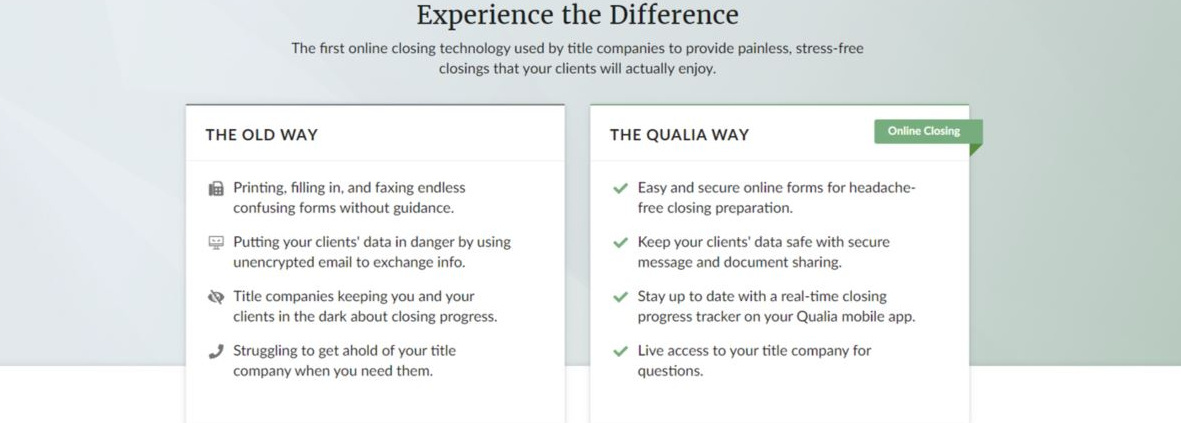

workflow automation

Digital systems are becoming more and more popular: paper has finally become obsolete. This not only eliminates duplication and sources of error; the digital tools can control and support all transactions with workflow.

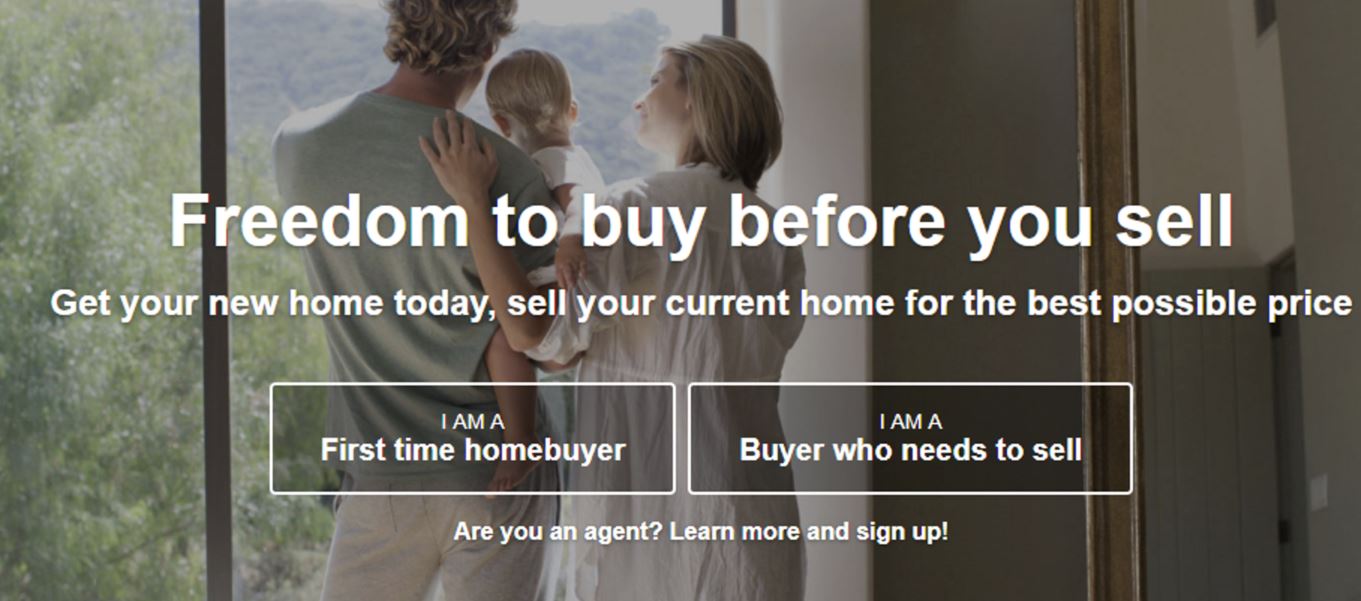

Alternative financing models for residential properties

More and more providers are penetrating the financing market. In addition to banks and insurance companies, pension funds and private equity companies have also joined the ranks. The institutions offer a combination of brokerage and financing solutions, guarantee fixed purchase prices or provide interim financing so that the new house can be bought before the old one is sold.

Digitized buildings

In the future, more and more buildings will be digitally planned and constructed: They will send data and make decisions. This not only saves energy and manpower, but also allows you to intervene in the building at certain points during conversions and renovations.

Marketplaces for commercial properties

At present, the marketplaces are sufficient for the sale of residential properties. This will change so that commercial properties, hotels, shopping centres etc. can also be sold via online marketplaces. This is aimed at the large brokerage companies (JLL, CBRE, etc.), which are still happy to conduct the brokerage business without a marketplace on their own platforms and marketing channels. In view of the sharp fall in margins, the digitalisation of the sale of commercial properties via marketplaces is foreseeable.

Blockchain technology for mortgages

Blockchain technology is particularly suitable for the unbureaucratic administration of owners of mortgages and transfer of titles to new mortgagees. Blockchain never forgets and will lead to the fact that you may no longer need land registers. In America, the technology will be used more quickly than in Switzerland, since in the USA a purchase of land can already be carried out completely digitally.

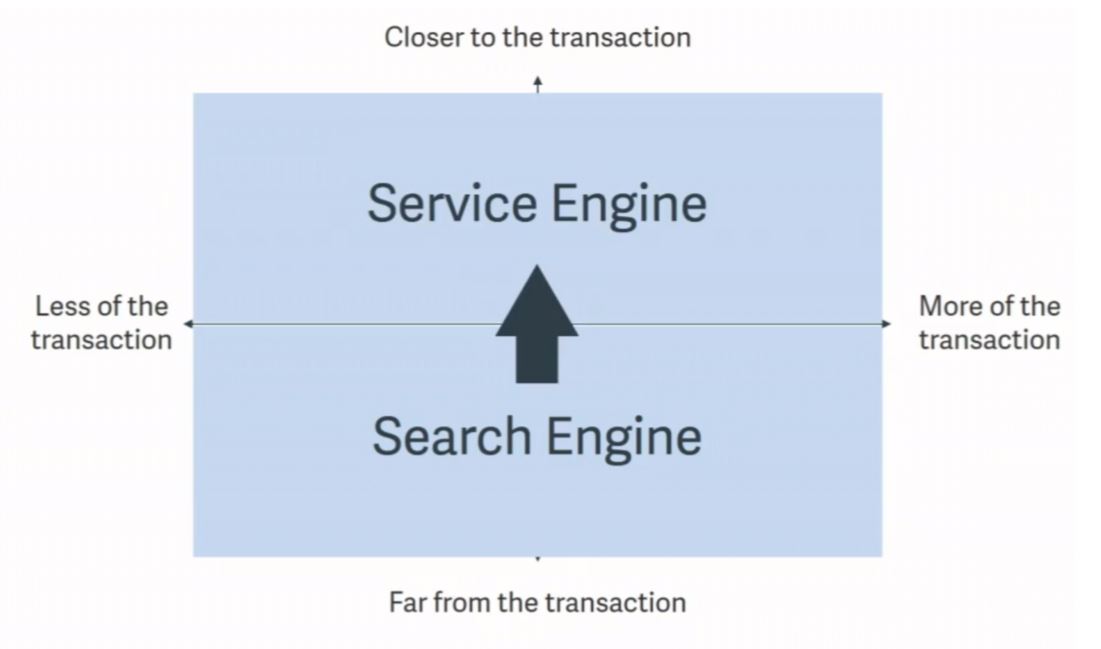

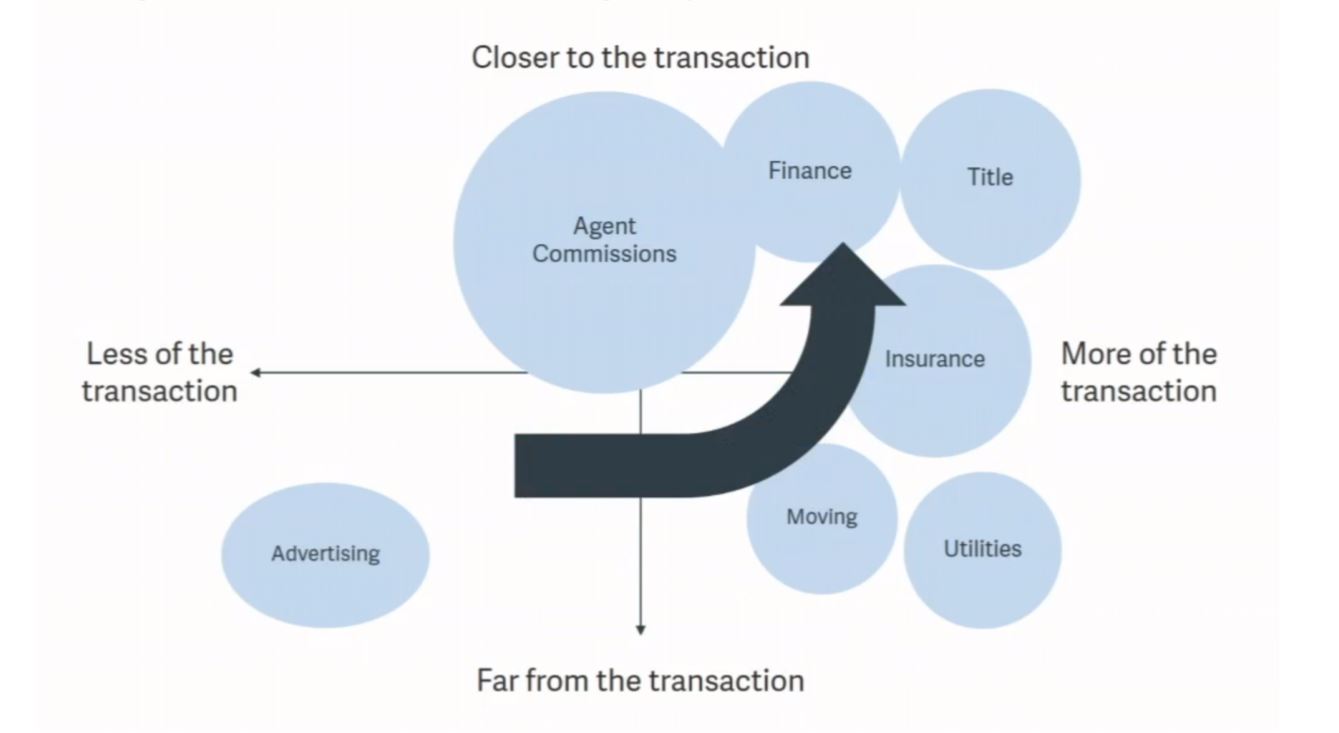

Marketplaces become service machines

Marketplaces will expand their business model, which currently works on the basis of an advertising platform. They are already attacking the brokers' commission. They also want to earn money by brokering financing, insurance, relocation services and other services. Marketplaces are mutating into service providers who are trying to displace traditional real estate agents. They want to be closer to the transaction with the aim of processing more of the transactions.

Marketplaces want a share of transaction costs

The great added value of the marketplaces no longer lies in the (rising) insertion costs, but in the high brokerage fees, which in the USA still account for 6-7% of the purchase price. Disruptively, the marketplaces want to participate in the commissions of the traditional brokers or replace them immediately. But other sources of transaction costs such as insurance, mortgages, relocation costs, etc. are also tapped.

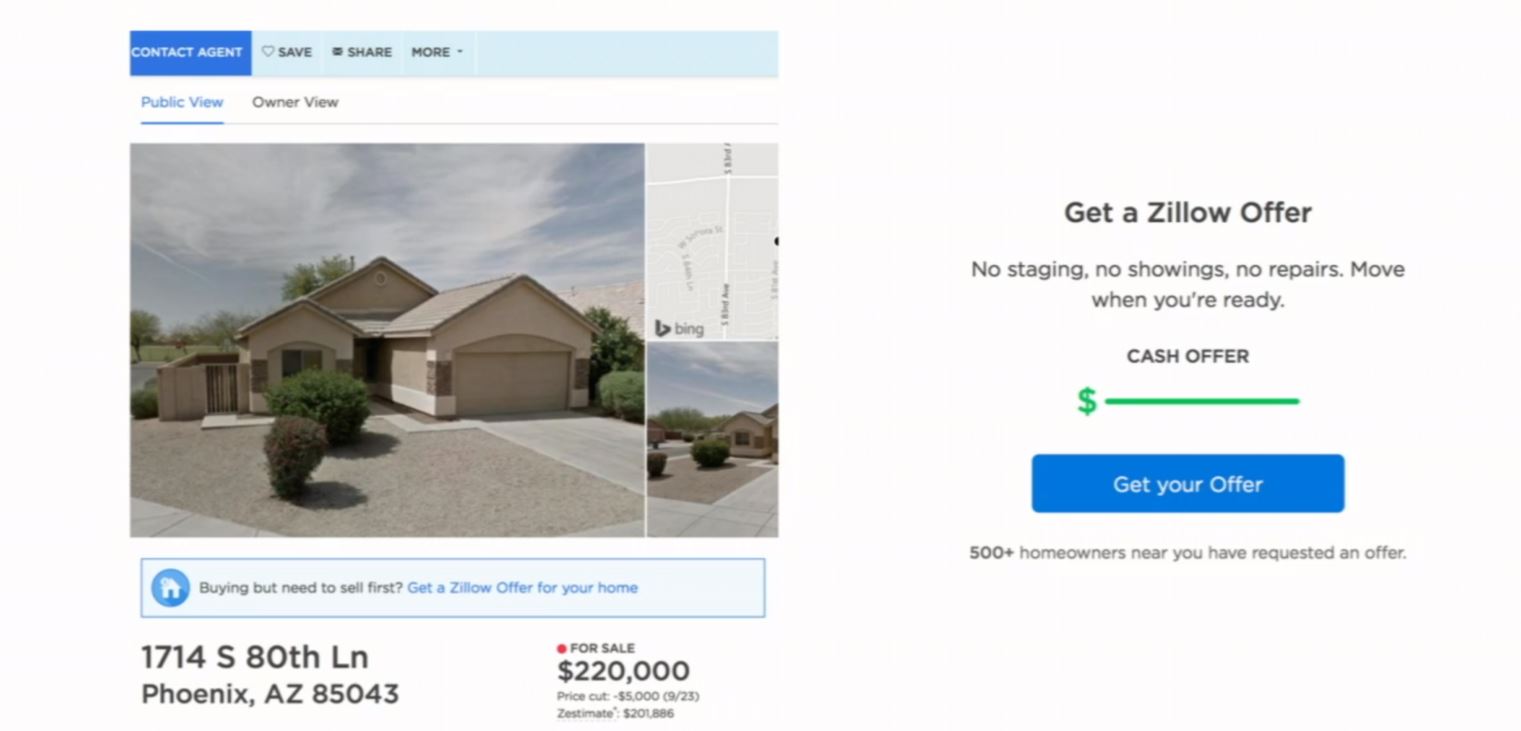

iBuyer programs as an alternative to traditional sales between private individual

iBuyers are investors who use hedonic real estate valuations and other technologies to place quick offers for overly favorably priced properties and distressed sales, make purchases within a few days and then resell the properties.

The iBuyers usually carry out minor repairs and maintenance work, put the object back on the net after a few weeks and sell it with a profit of 4-8%. The key to the business model is to buy as many properties as possible as quickly as possible and sell them at a higher price.

In America, companies are financed with billions for iBuyer programs. Currently Zillow, Open Door and Offerpad are the leading companies in the iBuyer market. The iBuyers still have a small market share of 0.2% nationwide; in some regions, such as Phoenix, the market share is already 5%. The average purchase price is approx. USD 250-300'000.

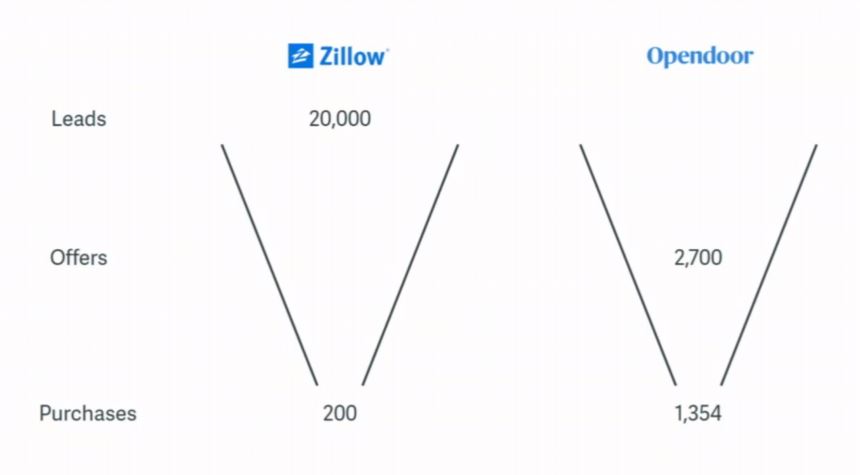

iBuyer Programs as Lead Generator

The activities of Zillow, the largest American Internet marketplace, are exciting. The company offered 20,000 homeowners the opportunity to buy their property, but only bought 200. With the iBuyer program, Zillow was then able to generate 19,800 leads, which it could offer again to other brokers as potential seller leads. Disruptive business models (mediation of the lead with participation in the broker's margin) are also in the foreground here.

Purple Bricks and Compass Group attack traditional brokers

In the USA, the companies Purple Bricks, Redfin and Compass are being financed with billions to attack or wipe out traditional brokers.

Compass has raised over a billion dollars from its investors (e.g. Softbank, Bain Capital and Goldman Sachs). They buy up competitors, say they invest a lot in technology and create a broker-friendly platform. Opponents accuse Compass of luring high-performance brokers with much deep fee share programs and high sign-on bonuses. The aim is to wipe out the traditional broker guild; thanks to the integrated IT platform, the value chain of real estate services should be better exploited.

Purple Bricks or Redfin work with fixed transaction fees and sometimes without a guarantee of success, so that costs are incurred depending on the market and country. Both companies are still making large losses as a result of the expansion strategy, and the question is how long investors will stay with the company. Purple Bricks recently lost its CEO due to disappointing business figures. In the US, the business model is also on the brink of collapse: a commission model is being examined.

Axel Springer, a German media company, acquired a USD 177 million interest in Purple Bricks. In Germany, Axel Springer and Purple Bricks participate in Homeday with EUR 20 million. It can be assumed that Purple Bricks plans to enter the German market via Homeday and possibly other startups (e.g. Maklaro). In Switzerland, Axel Springer also has digital cooperation agreements with Ringier (e.g. Admeira AG), which in turn has a 50% stake in Immoscout AG.

A few Purple Bricks imitation products have also already gained a foothold in Switzerland. They demand an advance payment and offer the mediation at a fixed price. The models are based on the sale of services without having to be successful. If such a company acquires five sales mandates of CHF 7,000 each, CHF 35,000 in revenue is collected in advance. If only one property is successfully brokered, a commission of CHF 35,000 is charged on the transaction. With an average Swiss house price of CHF 700-800,000, this is 4-5% per successful transaction.