The past decade, with its expansive monetary policy and historically low mortgage interest rates, has fired the desire for home ownership. Even today, the latest signals from the economy do not give much hope of a turnaround. Homeowners will probably be able to enjoy low financing costs for a long time to come. If the imputed rental value were to disappear, price pressure in markets in good demand could even intensify. As good as it sounds, immigration, employment and purchasing power, together with low interest rates and political conditions, are the foundations for stable real estate prices. Some of these economic pillars show cyclical weakness in old age and, it should be noted, at a time when the National Bank's monetary policy instruments are largely exhausted. On the supply and demand side, the first changes in the regional framework conditions are becoming apparent. More and more often, "keep an eye out when buying real estate" and "check carefully who is committed to the long term".

Hedonic valuation model

Digitalization has already hit the valuation system at the turn of the millennium and successfully supplemented it. Transaction and property data are recorded by banks according to uniform standards and enriched with municipal and geodata. Banks use this form of price plausibility checking for around 80 percent of transactions taking place today. Price band deviations of +/- 15 percent from the statistical value are accepted in principle without further questions or inspections of the property. What is justifiable from the portfolio point of view of a bank means for the individual buyer in the worst case the partial destruction of the own funds. A correct, uniform and honest recording of the valuation object is therefore the basic rule for usable results.

Important: Hedonic valuation models are only suitable for marketable properties without specialities. Unconventional construction methods, structural restrictions, expansion options or obligations arising from annotations, preregistrations, easements, regulations or ancillary cost agreements are not taken into account when determining the value.

Professional appraisals are indispensable

For most private households in Switzerland, owner-occupied homes represent the largest investment in life. This makes it all the more important to optimally support and coordinate the various stakeholders in this process (buyers, sellers, builders and financing institutions). The purchase of residential property is often an emotional act that touches all human senses. Where conventional comparative value methods and hedonic models provide too little information, mediating experts are in demand. A number of questions come into play in the valuation of owner-occupied homes that are not apparent at first glance, but can cause major differences between comparable properties. A professional property valuation is always based on the sum of these factors and takes into account opportunities, risks, potentials and the legal conditions arising from the land register and public building law. In addition to classic asset valuations, which take into account land, buildings, surroundings and ancillary building costs, the capitalised earnings method is also increasingly being used.

|

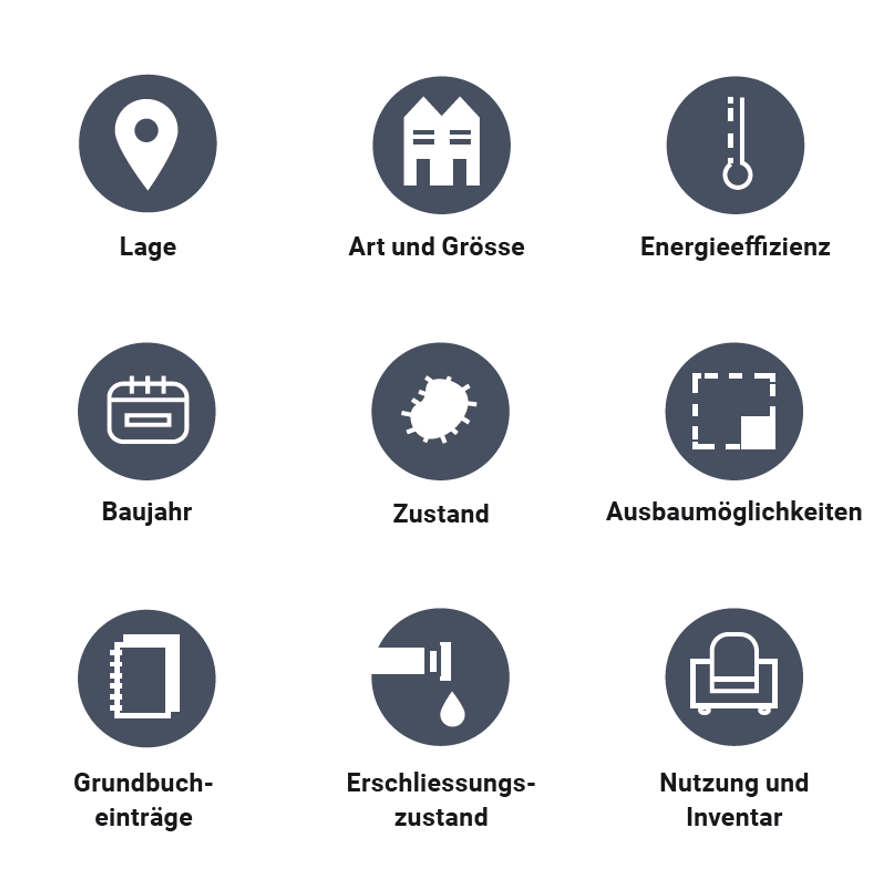

The assessment factors include location, type and size, energy efficiency, year of construction, condition, expansion options, development status, use and inventory, and land register entries.

|

Valuations in the age of digitisation

Market data and municipal reports are now available. Ginesta Immobilien therefore uses the latest valuation and market data tools in order to meet the increased requirements of the valuation industry.

As a long-standing, renowned real estate company, we also benefit from countless transaction data of our own, which we can include in our valuation as comparable objects. Our valuation solutions enable efficient processes for complex real value, capitalized earnings or discounted cash flow valuations.

Services Ginesta Valuation Desk

• Valuation of single-family houses and condominiums

• Evaluation of apartment, residential and commercial buildings

• Valuation of commercial and industrial properties

• Valuation of gastronomy and hotel properties

• Valuation of real estate

• Project assessments from development to implementation

• Assessment of building law, residential law or usufruct situations

• Portfolio valuations

• Market and location analyses

COSTS AND DURATION OF A PROPERTY VALUATION

|

Head of Estimation Desk, Ginesta Bankkaufmann, |

If you would like to know how much your property is worth, click here for a free online estimate.

Information on personal professional advice can be found here.

Here you can find the complete article in German for download as PDF.